获取行情示例

按品种划分

两融

获取融资融券账户可融资买入标的

#coding:gbk

def init(C):

r = get_assure_contract('123456789')

if len(r) == 0:

print('未取到担保明细')

else:

finable = [o.m_strInstrumentID+'.'+o.m_strExchangeID for o in r if o.m_eFinStatus==48]

print('可融资买入标的:', finable)

按功能划分

订阅K线全推

提示

- K线全推需要VIP权限,非VIP用户请勿使用此功能

订阅全市场1m周期K线

#coding:gbk

import pandas as pd

import numpy as np

def init(C):

stock_list = C.get_stock_list_in_sector("沪深A股")

sub_num_dict = {i:C.subscribe_quote(

stock_code = i,

period = '1m',

dividend_type = 'none',

result_type = 'dict', # 回调函数的行情数据格式

callback = call_back # 指定一个自定义的函数接收行情,自定义的函数只能有一个位置参数

) for i in stock_list}

def call_back(data):

print(data)

获取N分钟周期K线数据

提示

- 获取历史N分钟数据前,需要先下载历史数据

- 1m以上,5m以下的数据,是通过1m数据合成的

- 5m以上,1d以下的数据,是通过5m数据合成的

- 1d以上的数据,是通过1d的数据合成的

#coding:gbk

import pandas as pd

import numpy as np

def init(C):

# start_date = '20231001'# 格式"YYYYMMDD",开始下载的日期,date = ""时全量下载

start_date = '20231001'# 格式"YYYYMMDD",开始下载的日期,date = ""时增量下载

end_date = "" # 格式同上,下载结束时间

period = "3m" # 数据周期

need_download = 1 # 取数据是空值时,将need_download赋值为1,确保正确下载了历史数据

# code_list = ["110052.SH"] # 可转债

# code_list = ["rb2401.SF", "FG403.ZF"] # 期货列表

# code_list = ["HO2310-P-2500.IF"] # 期权列表

code_list = ["000001.SZ", "600519.SH"] # 股票列表

# 判断要不要下载数据

if need_download:

my_download(code_list, period, start_date, end_date)

# 取数据

data = C.get_market_data_ex([],code_list,period = period, start_time = start_date, end_time = end_date,dividend_type = "back_ratio")

print(data)# 行情数据查看

print(C.get_instrumentdetail(code_list[0])) # 合约信息查看

def hanldebar(C):

return

def my_download(stock_list,period,start_date = '', end_date = ''):

'''

用于显示下载进度

'''

if "d" in period:

period = "1d"

elif "m" in period:

if int(period[0]) < 5:

period = "1m"

else:

period = "5m"

elif "tick" == period:

pass

else:

raise KeyboardInterrupt("周期传入错误")

n = 1

num = len(stock_list)

for i in stock_list:

print(f"当前正在下载{n}/{num}")

download_history_data(i,period,start_date, end_date)

n += 1

print("下载任务结束")

获取 Lv1 行情数据

本示例用于说明如何通过函数获取行情数据。

#coding:gbk

# get_market_data_ex(subscribe=True)有订阅股票数量限制

# 即stock_list参数的数量不能超过500

# get_market_data_ex(subscribe=False) 该模式下(非订阅模式),接口会从本地行情文件里获取数据,不会获取动态行情数,且不受订阅数限制,但需要提前下载数据

# 下载数据在 操作/数据管理/补充数据选项卡里,按照页面提示下载数据

# get_market_data_ex(subscribe=True) 该模式下(订阅模式),受订阅数量上限限制,可以取到动态行情

# 建议每天盘后增量补充对应周期的行情

import time

def init(C):

C.stock = C.stockcode + '.' + C.market

# 获取指定时间的k线

price = C.get_market_data_ex(['open','high','low','close'], [C.stock], start_time='', end_time='',period='1d', subscribe=False)

print(price[C.stock].head())

def handlebar(C):

bar_timetag = C.get_bar_timetag(C.barpos)

bar_date = timetag_to_datetime(bar_timetag, '%Y%m%d%H%M%S')

print('获取截至到%s为止前5根k线的开高低收等字段:'%(bar_date))

# 获取截至今天为止前30根k线

price = C.get_market_data_ex(

[], [C.stock],

end_time=bar_date,

period=C.period,

subscribe=True,

count=5,

)

print(price[C.stock].to_dict('dict'))

获取 Lv2 数据(需要数据源支持)

方法1 - 查询LV2数据

使用该函数后,会定期查询最新数据,并进行数据返回。

#coding:gbk

def init(C):

C.sub_nums = []

C.stock = C.stockcode+'.'+C.market

for field in ['l2transaction', 'l2order', 'l2transactioncount', 'l2quote']:

num = C.subscribe_quote(C.stock, period=field,

dividend_type='follow',

)

C.sub_nums.append(num)

def handlebar(C):

if not C.is_last_bar():

return

price = C.get_market_data_ex([],[C.stock],period='l2transaction',count=10)[C.stock]

price_dict = price.to_dict('index')

print(price_dict)

for pos, t in enumerate(price_dict):

print(f" 逐笔成交:{pos+1} 时间:{price_dict[t]['stime']}, 时间戳:{price_dict[t]['time']}, 成交价:{price_dict[t]['price']}, \

成交量:{price_dict[t]['volume']}, 成交额:{price_dict[t]['amount']} \

成交记录号:{price_dict[t]['tradeIndex']}, 买方委托号:{price_dict[t]['buyNo']},\

卖方委托号:{price_dict[t]['sellNo']}, 成交类型:{price_dict[t]['tradeType']}, \

成交标志:{price_dict[t]['tradeFlag']}, ")

price = C.get_market_data_ex([],[C.stock],period='l2quote',count=10)[C.stock]

price_dict = price.to_dict('index')

print(price_dict)

for pos, t in enumerate(price_dict):

print(f" 十档快照:{pos+1} 时间:{price_dict[t]['stime']}, 时间戳:{price_dict[t]['time']}, 最新价:{price_dict[t]['lastPrice']}, \

开盘价:{price_dict[t]['open']}, 最高价:{price_dict[t]['high']} 最低价:{price_dict[t]['low']}, 成交额:{price_dict[t]['amount']},\

成交总量:{price_dict[t]['volume']}, 原始成交总量:{price_dict[t]['pvolume']}, 证券状态:{price_dict[t]['stockStatus']}, 持仓量:{price_dict[t]['openInt']},\

成交笔数:{price_dict[t]['transactionNum']},前收盘价:{price_dict[t]['lastClose']},多档委卖价:{price_dict[t]['askPrice']},多档委卖量:{price_dict[t]['askVol']},\

多档委买价:{price_dict[t]['bidPrice']},多档委买量:{price_dict[t]['bidVol']}")

price = C.get_market_data_ex([],[C.stock],period='l2order',count=10)[C.stock]

price_dict = price.to_dict('index')

for pos, t in enumerate(price_dict):

print(f" 逐笔委托:{pos+1} 时间:{price_dict[t]['stime']}, 时间戳:{price_dict[t]['time']}, 委托价:{price_dict[t]['price']}, \

委托量:{price_dict[t]['volume']}, 委托号:{price_dict[t]['entrustNo']} \

委托类型:{price_dict[t]['entrustType']}, 委托方向:{price_dict[t]['entrustDirection']},\

")

# 委托类型: 0:未知 1: 买入,2: 卖出,3: 撤单

price = C.get_market_data_ex([],[C.stock],period='l2transactioncount',count=10)[C.stock]

price_dict = price.to_dict('index')

for pos, t in enumerate(price_dict):

print('大单统计:', price_dict[t])

def stop(C):

for num in C.sub_nums:

C.unsubscribe_quote(num)

{'20240220150000.000': {'amount': 2946.0, 'buyNo': 33949158, 'price': 9.82, 'sellNo': 33860170, 'seq': 33952658, 'stime': '20240220150000.000', 'time': 1708412400000, 'tradeFlag': 1, 'tradeIndex': 33952658, 'tradeType': 0, 'volume': 300}}

逐笔成交:1 时间:20240220150000.000, 时间戳:1708412400000, 成交价:9.82, 成交量:300, 成交额:2946.0 成交记录号:33952658, 买方委托号:33949158,卖方委托号:33860170, 成交类型:0, 成交标志:1,

{'20240220145839.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [12462, 666, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [12462, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145839.000', 'stockStatus': 8, 'time': 1708412319000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145848.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [12587, 586, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [12587, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145848.000', 'stockStatus': 8, 'time': 1708412328000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145857.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [13735, 2880, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [13735, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145857.000', 'stockStatus': 8, 'time': 1708412337000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145906.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [14206, 2650, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [14206, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145906.000', 'stockStatus': 8, 'time': 1708412346000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145915.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [14410, 2671, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [14410, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145915.000', 'stockStatus': 8, 'time': 1708412355000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145924.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [15925, 1564, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [15925, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145924.000', 'stockStatus': 8, 'time': 1708412364000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145933.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [16241, 1873, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [16241, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145933.000', 'stockStatus': 8, 'time': 1708412373000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145942.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [17643, 529, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [17643, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145942.000', 'stockStatus': 8, 'time': 1708412382000, 'transactionNum': 52246, 'volume': 1105052}, '20240220145951.000': {'amount': 1080809029.2600002, 'askPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'askVol': [18262, 620, 0, 0, 0, 0, 0, 0, 0, 0], 'bidPrice': [9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0], 'bidVol': [18262, 0, 0, 0, 0, 0, 0, 0, 0, 0], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 18, 'pvolume': 110505198, 'settlementPrice': 0.0, 'stime': '20240220145951.000', 'stockStatus': 8, 'time': 1708412391000, 'transactionNum': 52246, 'volume': 1105052}, '20240220150000.000': {'amount': 1098987813.26, 'askPrice': [9.82, 9.83, 9.84, 9.85, 9.86, 9.87, 9.879999999999999, 9.889999999999999, 9.899999999999999, 9.909999999999998], 'askVol': [5810, 13718, 16260, 14328, 5391, 7251, 11538, 5153, 5390, 1508], 'bidPrice': [9.81, 9.8, 9.790000000000001, 9.780000000000001, 9.770000000000001, 9.760000000000002, 9.750000000000002, 9.740000000000002, 9.730000000000002, 9.720000000000002], 'bidVol': [2123, 6962, 8252, 3011, 3118, 2448, 5289, 3242, 9223, 6510], 'high': 9.84, 'lastClose': 9.81, 'lastPrice': 9.82, 'lastSettlementPrice': 0.0, 'low': 9.73, 'open': 9.790000000000001, 'openInt': 15, 'pvolume': 112356398, 'settlementPrice': 0.0, 'stime': '20240220150000.000', 'stockStatus': 5, 'time': 1708412400000, 'transactionNum': 52729, 'volume': 1123564}}

十档快照:1 时间:20240220145839.000, 时间戳:1708412319000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[12462, 666, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[12462, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:2 时间:20240220145848.000, 时间戳:1708412328000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[12587, 586, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[12587, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:3 时间:20240220145857.000, 时间戳:1708412337000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[13735, 2880, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[13735, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:4 时间:20240220145906.000, 时间戳:1708412346000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[14206, 2650, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[14206, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:5 时间:20240220145915.000, 时间戳:1708412355000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[14410, 2671, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[14410, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:6 时间:20240220145924.000, 时间戳:1708412364000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[15925, 1564, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[15925, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:7 时间:20240220145933.000, 时间戳:1708412373000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[16241, 1873, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[16241, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:8 时间:20240220145942.000, 时间戳:1708412382000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[17643, 529, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[17643, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:9 时间:20240220145951.000, 时间戳:1708412391000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1080809029.2600002,成交总量:1105052, 原始成交总量:110505198, 证券状态:8, 持仓量:18,成交笔数:52246,前收盘价:9.81,多档委卖价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委卖量:[18262, 620, 0, 0, 0, 0, 0, 0, 0, 0],多档委买价:[9.82, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0, 0.0],多档委买量:[18262, 0, 0, 0, 0, 0, 0, 0, 0, 0]

十档快照:10 时间:20240220150000.000, 时间戳:1708412400000, 最新价:9.82, 开盘价:9.790000000000001, 最高价:9.84 最低价:9.73, 成交额:1098987813.26,成交总量:1123564, 原始成交总量:112356398, 证券状态:5, 持仓量:15,成交笔数:52729,前收盘价:9.81,多档委卖价:[9.82, 9.83, 9.84, 9.85, 9.86, 9.87, 9.879999999999999, 9.889999999999999, 9.899999999999999, 9.909999999999998],多档委卖量:[5810, 13718, 16260, 14328, 5391, 7251, 11538, 5153, 5390, 1508],多档委买价:[9.81, 9.8, 9.790000000000001, 9.780000000000001, 9.770000000000001, 9.760000000000002, 9.750000000000002, 9.740000000000002, 9.730000000000002, 9.720000000000002],多档委买量:[2123, 6962, 8252, 3011, 3118, 2448, 5289, 3242, 9223, 6510]

逐笔委托:1 时间:20240220145956.680, 时间戳:1708412396680, 委托价:9.83, 委托量:1500, 委托号:33949047 委托类型:1, 委托方向:1,

逐笔委托:2 时间:20240220145956.730, 时间戳:1708412396730, 委托价:9.82, 委托量:500, 委托号:33949086 委托类型:1, 委托方向:1,

逐笔委托:3 时间:20240220145956.770, 时间戳:1708412396770, 委托价:9.8, 委托量:300000, 委托号:33949126 委托类型:1, 委托方向:2,

逐笔委托:4 时间:20240220145956.810, 时间戳:1708412396810, 委托价:9.82, 委托量:300, 委托号:33949158 委托类型:1, 委托方向:1,

逐笔委托:5 时间:20240220145957.180, 时间戳:1708412397180, 委托价:9.8, 委托量:18600, 委托号:33949592 委托类型:1, 委托方向:2,

逐笔委托:6 时间:20240220145957.580, 时间戳:1708412397580, 委托价:9.82, 委托量:100, 委托号:33949982 委托类型:1, 委托方向:2,

逐笔委托:7 时间:20240220145958.300, 时间戳:1708412398300, 委托价:9.8, 委托量:84700, 委托号:33950549 委托类型:1, 委托方向:2,

逐笔委托:8 时间:20240220145958.320, 时间戳:1708412398320, 委托价:9.83, 委托量:1200, 委托号:33950573 委托类型:1, 委托方向:1,

逐笔委托:9 时间:20240220145958.450, 时间戳:1708412398450, 委托价:9.81, 委托量:83800, 委托号:33950686 委托类型:1, 委托方向:2,

逐笔委托:10 时间:20240220145959.100, 时间戳:1708412399100, 委托价:9.83, 委托量:1300, 委托号:33951170 委托类型:1, 委托方向:2,

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124399721.0, 'bidMediumVolmue': 127143, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12867, 'bidSmallAmount': 81248200.0, 'bidSmallVolmue': 83072, 'ddx': 0.0, 'ddy': 4.03, 'ddz': -0.02, 'netOrder': -374, 'netWithdraw': 16, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120132514.0, 'offMediumVolmue': 122938, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13948, 'offSmallAmount': 97078349.0, 'offSmallVolmue': 99424, 'stime': '20240220145636.000', 'time': 1708412196000, 'unactiveBidBigAmount': 181050089.0, 'unactiveBidBigVolmue': 185301, 'unactiveBidMediumAmount': 166479412.0, 'unactiveBidMediumVolmue': 170418, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 89966179.0, 'unactiveBidSmallVolmue': 92168, 'unactiveOffBigAmount': 177098765.0, 'unactiveOffBigVolmue': 180907, 'unactiveOffMediumAmount': 170938705.0, 'unactiveOffMediumVolmue': 174590, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13979, 'withdrawOff': 9278, 'zjbyBig': 7872534, 'zjbyMedium': 4267206, 'zjbyMost': -1888909, 'zjbyNetInflow': -5579317, 'zjbySmall': -15830148}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124399721.0, 'bidMediumVolmue': 127143, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12867, 'bidSmallAmount': 81248200.0, 'bidSmallVolmue': 83072, 'ddx': 0.0, 'ddy': 4.03, 'ddz': -0.02, 'netOrder': -374, 'netWithdraw': 12, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120132514.0, 'offMediumVolmue': 122938, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13950, 'offSmallAmount': 97112684.0, 'offSmallVolmue': 99459, 'stime': '20240220145638.000', 'time': 1708412198000, 'unactiveBidBigAmount': 181084424.0, 'unactiveBidBigVolmue': 185336, 'unactiveBidMediumAmount': 166479412.0, 'unactiveBidMediumVolmue': 170418, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 89966179.0, 'unactiveBidSmallVolmue': 92168, 'unactiveOffBigAmount': 177098765.0, 'unactiveOffBigVolmue': 180907, 'unactiveOffMediumAmount': 170938705.0, 'unactiveOffMediumVolmue': 174590, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13981, 'withdrawOff': 9280, 'zjbyBig': 7872534, 'zjbyMedium': 4267206, 'zjbyMost': -1888909, 'zjbyNetInflow': -5613652, 'zjbySmall': -15864483}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12872, 'bidSmallAmount': 81264894.0, 'bidSmallVolmue': 83089, 'ddx': 0.0, 'ddy': 4.06, 'ddz': -0.02, 'netOrder': -5, 'netWithdraw': 13, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120318904.0, 'offMediumVolmue': 123128, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13962, 'offSmallAmount': 97206860.0, 'offSmallVolmue': 99555, 'stime': '20240220145642.000', 'time': 1708412202000, 'unactiveBidBigAmount': 181363028.0, 'unactiveBidBigVolmue': 185620, 'unactiveBidMediumAmount': 166479412.0, 'unactiveBidMediumVolmue': 170418, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 89968141.0, 'unactiveBidSmallVolmue': 92170, 'unactiveOffBigAmount': 177369797.0, 'unactiveOffBigVolmue': 181183, 'unactiveOffMediumAmount': 170784531.0, 'unactiveOffMediumVolmue': 174433, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13987, 'withdrawOff': 9283, 'zjbyBig': 7872534, 'zjbyMedium': 4180980, 'zjbyMost': -1888909, 'zjbyNetInflow': -5777360, 'zjbySmall': -15941965}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12872, 'bidSmallAmount': 81264894.0, 'bidSmallVolmue': 83089, 'ddx': 0.0, 'ddy': 4.06, 'ddz': -0.02, 'netOrder': -5, 'netWithdraw': 11, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120503332.0, 'offMediumVolmue': 123316, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13963, 'offSmallAmount': 97206860.0, 'offSmallVolmue': 99555, 'stime': '20240220145643.000', 'time': 1708412203000, 'unactiveBidBigAmount': 181363028.0, 'unactiveBidBigVolmue': 185620, 'unactiveBidMediumAmount': 166562797.0, 'unactiveBidMediumVolmue': 170503, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 90069184.0, 'unactiveBidSmallVolmue': 92273, 'unactiveOffBigAmount': 177369797.0, 'unactiveOffBigVolmue': 181183, 'unactiveOffMediumAmount': 170784531.0, 'unactiveOffMediumVolmue': 174433, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13989, 'withdrawOff': 9283, 'zjbyBig': 7872534, 'zjbyMedium': 3996552, 'zjbyMost': -1888909, 'zjbyNetInflow': -5961788, 'zjbySmall': -15941965}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12873, 'bidSmallAmount': 81274714.0, 'bidSmallVolmue': 83099, 'ddx': 0.0, 'ddy': 4.07, 'ddz': -0.02, 'netOrder': 248, 'netWithdraw': 12, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120503332.0, 'offMediumVolmue': 123316, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13967, 'offSmallAmount': 97279454.0, 'offSmallVolmue': 99629, 'stime': '20240220145648.000', 'time': 1708412208000, 'unactiveBidBigAmount': 181363028.0, 'unactiveBidBigVolmue': 185620, 'unactiveBidMediumAmount': 166635391.0, 'unactiveBidMediumVolmue': 170577, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 90069184.0, 'unactiveBidSmallVolmue': 92273, 'unactiveOffBigAmount': 177379617.0, 'unactiveOffBigVolmue': 181193, 'unactiveOffMediumAmount': 170784531.0, 'unactiveOffMediumVolmue': 174433, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13992, 'withdrawOff': 9290, 'zjbyBig': 7872534, 'zjbyMedium': 3996552, 'zjbyMost': -1888909, 'zjbyNetInflow': -6024562, 'zjbySmall': -16004739}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12875, 'bidSmallAmount': 81313012.0, 'bidSmallVolmue': 83138, 'ddx': 0.0, 'ddy': 4.07, 'ddz': -0.02, 'netOrder': 248, 'netWithdraw': 17, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120556306.0, 'offMediumVolmue': 123370, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13968, 'offSmallAmount': 97279454.0, 'offSmallVolmue': 99629, 'stime': '20240220145650.000', 'time': 1708412210000, 'unactiveBidBigAmount': 181565114.0, 'unactiveBidBigVolmue': 185826, 'unactiveBidMediumAmount': 166479412.0, 'unactiveBidMediumVolmue': 170418, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 90076051.0, 'unactiveBidSmallVolmue': 92280, 'unactiveOffBigAmount': 177417915.0, 'unactiveOffBigVolmue': 181232, 'unactiveOffMediumAmount': 170784531.0, 'unactiveOffMediumVolmue': 174433, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13997, 'withdrawOff': 9292, 'zjbyBig': 7872534, 'zjbyMedium': 3943578, 'zjbyMost': -1888909, 'zjbyNetInflow': -6039238, 'zjbySmall': -15966441}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12877, 'bidSmallAmount': 81323814.0, 'bidSmallVolmue': 83149, 'ddx': 0.0, 'ddy': 4.07, 'ddz': -0.02, 'netOrder': -6373, 'netWithdraw': 16, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120611242.0, 'offMediumVolmue': 123426, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13971, 'offSmallAmount': 97326542.0, 'offSmallVolmue': 99677, 'stime': '20240220145654.000', 'time': 1708412214000, 'unactiveBidBigAmount': 181565114.0, 'unactiveBidBigVolmue': 185826, 'unactiveBidMediumAmount': 166528462.0, 'unactiveBidMediumVolmue': 170468, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 90129025.0, 'unactiveBidSmallVolmue': 92334, 'unactiveOffBigAmount': 177428717.0, 'unactiveOffBigVolmue': 181243, 'unactiveOffMediumAmount': 170784531.0, 'unactiveOffMediumVolmue': 174433, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 13999, 'withdrawOff': 9299, 'zjbyBig': 7872534, 'zjbyMedium': 3888642, 'zjbyMost': -1888909, 'zjbyNetInflow': -6130460, 'zjbySmall': -16002727}

大单统计: {'bidBigAmount': 152925991.0, 'bidBigVolmue': 156226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12877, 'bidSmallAmount': 81323814.0, 'bidSmallVolmue': 83149, 'ddx': 0.0, 'ddy': 4.09, 'ddz': -0.02, 'netOrder': -6373, 'netWithdraw': 15, 'offBigAmount': 145053456.0, 'offBigVolmue': 148447, 'offMediumAmount': 120611242.0, 'offMediumVolmue': 123426, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13976, 'offSmallAmount': 97372649.0, 'offSmallVolmue': 99724, 'stime': '20240220145656.000', 'time': 1708412216000, 'unactiveBidBigAmount': 181565114.0, 'unactiveBidBigVolmue': 185826, 'unactiveBidMediumAmount': 166577512.0, 'unactiveBidMediumVolmue': 170518, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 90126082.0, 'unactiveBidSmallVolmue': 92331, 'unactiveOffBigAmount': 177428717.0, 'unactiveOffBigVolmue': 181243, 'unactiveOffMediumAmount': 170784531.0, 'unactiveOffMediumVolmue': 174433, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 109991285.0, 'unactiveOffSmallVolmue': 112357, 'withdrawBid': 14002, 'withdrawOff': 9302, 'zjbyBig': 7872534, 'zjbyMedium': 3888642, 'zjbyMost': -1888909, 'zjbyNetInflow': -6176567, 'zjbySmall': -16048834}

大单统计: {'bidBigAmount': 153907941.0, 'bidBigVolmue': 157226, 'bidMediumAmount': 124499885.0, 'bidMediumVolmue': 127245, 'bidMostAmount': 177571807.0, 'bidMostVolmue': 181294, 'bidNumber': 12881, 'bidSmallAmount': 81386627.0, 'bidSmallVolmue': 83213, 'ddx': 0.0, 'ddy': 4.09, 'ddz': -0.02, 'netOrder': -324, 'netWithdraw': 9, 'offBigAmount': 145951071.0, 'offBigVolmue': 149362, 'offMediumAmount': 120611242.0, 'offMediumVolmue': 123426, 'offMostAmount': 179460717.0, 'offMostVolmue': 183675, 'offNumber': 13980, 'offSmallAmount': 97419737.0, 'offSmallVolmue': 99772, 'stime': '20240220145659.000', 'time': 1708412219000, 'unactiveBidBigAmount': 181946723.0, 'unactiveBidBigVolmue': 186215, 'unactiveBidMediumAmount': 167049373.0, 'unactiveBidMediumVolmue': 170999, 'unactiveBidMostAmount': 104229355.0, 'unactiveBidMostVolmue': 106597, 'unactiveBidSmallAmount': 90217315.0, 'unactiveBidSmallVolmue': 92424, 'unactiveOffBigAmount': 178280111.0, 'unactiveOffBigVolmue': 182110, 'unactiveOffMediumAmount': 170956296.0, 'unactiveOffMediumVolmue': 174608, 'unactiveOffMostAmount': 78116964.0, 'unactiveOffMostVolmue': 79881, 'unactiveOffSmallAmount': 110012889.0, 'unactiveOffSmallVolmue': 112379, 'withdrawBid': 14003, 'withdrawOff': 9304, 'zjbyBig': 7956869, 'zjbyMedium': 3888642, 'zjbyMost': -1888909, 'zjbyNetInflow': -6076507, 'zjbySmall': -16033109}

大单统计: {'bidBigAmount': 156870635.0, 'bidBigVolmue': 160243, 'bidMediumAmount': 126389253.0, 'bidMediumVolmue': 129169, 'bidMostAmount': 180761343.0, 'bidMostVolmue': 184542, 'bidNumber': 12970, 'bidSmallAmount': 81947349.0, 'bidSmallVolmue': 83784, 'ddx': 0.0, 'ddy': 4.21, 'ddz': -0.02, 'netOrder': 7661, 'netWithdraw': 9, 'offBigAmount': 148570065.0, 'offBigVolmue': 152029, 'offMediumAmount': 123102576.0, 'offMediumVolmue': 125963, 'offMostAmount': 182394933.0, 'offMostVolmue': 186663, 'offNumber': 14111, 'offSmallAmount': 98951657.0, 'offSmallVolmue': 101332, 'stime': '20240220150000.000', 'time': 1708412400000, 'unactiveBidBigAmount': 184733639.0, 'unactiveBidBigVolmue': 189053, 'unactiveBidMediumAmount': 168611735.0, 'unactiveBidMediumVolmue': 172590, 'unactiveBidMostAmount': 108729861.0, 'unactiveBidMostVolmue': 111180, 'unactiveBidSmallAmount': 90943995.0, 'unactiveBidSmallVolmue': 93164, 'unactiveOffBigAmount': 180480773.0, 'unactiveOffBigVolmue': 184351, 'unactiveOffMediumAmount': 174386422.0, 'unactiveOffMediumVolmue': 178101, 'unactiveOffMostAmount': 79344464.0, 'unactiveOffMostVolmue': 81131, 'unactiveOffSmallAmount': 111756921.0, 'unactiveOffSmallVolmue': 114155, 'withdrawBid': 14003, 'withdrawOff': 9304, 'zjbyBig': 8300569, 'zjbyMedium': 3286676, 'zjbyMost': -1633589, 'zjbyNetInflow': -7050651, 'zjbySmall': -17004307}

方法2 - 订阅LV2数据

此方法在发起订阅后,会自动收到所订阅数据,订阅方需要记录订阅函数返回的订阅号,并在不需要订阅时调用unsubscribe_quote反订阅数据,释放资源。

#coding:gbk

def l2_quote_callback(data):

for s in data:

print('lv2快照:',s, data[s])

def l2transaction_callback(data):

for s in data:

print('逐笔成交',s, data[s])

def l2order_callback(data):

for s in data:

print('逐笔委托',s, data[s])

def l2quoteaux_callback(data):

for s in data:

print('行情快照补充',s, data[s])

def l2transactioncount_callback(data):

for s in data:

print('大单统计',s, data[s])

def l2orderqueue_callback(data):

for s in data:

print('委买委卖队列',s, data[s])

def init(C):

C.stock = C.stockcode + '.' + C.market

# Level2 逐笔快照

C.subscribe_quote(C.stock, 'l2quote', result_type='dict', callback=l2_quote_callback)

# Level2 行情快照补充

C.subscribe_quote(C.stock, 'l2quoteaux', result_type='dict', callback=l2quoteaux_callback)

# Level2 逐笔成交

C.subscribe_quote(C.stock, 'l2transaction', result_type='dict', callback=l2transaction_callback)

# Level2 逐笔委托

C.subscribe_quote(C.stock, 'l2order', result_type='dict', callback=l2order_callback)

# Level2大单统计

C.subscribe_quote(C.stock, 'l2transactioncount', result_type='dict', callback=l2transactioncount_callback)

# Level2委买委卖队列

C.subscribe_quote(C.stock, 'l2orderqueue', result_type='dict', callback=l2orderqueue_callback)

def handlebar(C):

return

行情快照补充 000001.SZ {'time': 1708412400000, 'stime': '20240220150000.000', 'avgBidPrice': 9.59, 'totalBidQuantity': 109458, 'avgOffPrice': 10.22, 'totalOffQuantity': 246790, 'withdrawBidQuantity': 0, 'withdrawBidAmount': 0.0, 'withdrawOffQuantity': 0, 'withdrawOffAmount': 0.0}

lv2快照: 000001.SZ {'time': 1708412400000, 'stime': '20240220150000.000', 'lastPrice': 9.82, 'amount': 1098987813.26, 'volume': 1123564, 'pvolume': 112356398, 'openInt': 15, 'stockStatus': 5, 'lastSettlementPrice': 0.0, 'open': 9.790000000000001, 'high': 9.84, 'low': 9.73, 'settlementPrice': 0.0, 'lastClose': 9.81, 'transactionNum': 52729, 'askPrice': [9.82, 9.83, 9.84, 9.85, 9.86, 9.87, 9.879999999999999, 9.889999999999999, 9.899999999999999, 9.909999999999998], 'bidPrice': [9.81, 9.8, 9.790000000000001, 9.780000000000001, 9.770000000000001, 9.760000000000002, 9.750000000000002, 9.740000000000002, 9.730000000000002, 9.720000000000002], 'askVol': [5810, 13718, 16260, 14328, 5391, 7251, 11538, 5153, 5390, 1508], 'bidVol': [2123, 6962, 8252, 3011, 3118, 2448, 5289, 3242, 9223, 6510]}

委买委卖队列 000001.SZ {'time': 1708412400000, 'stime': '20240220150000.000', 'bidLevelPrice': 9.81, 'bidLevelVolume': [604, 5, 115, 10, 9, 5, 10, 1, 2, 12, 8, 5, 4, 50, 40, 100, 10, 5, 100, 52, 26, 29, 20, 2, 20, 5, 10, 10, 10, 115, 5, 239, 388, 6, 68, 23], 'offerLevelPrice': 9.82, 'offerLevelVolume': [58, 5, 10, 10, 5, 10, 30, 10, 8, 4, 65, 2, 10, 1, 1, 15, 20, 5, 20, 19, 39, 29, 20, 7, 20, 126, 4, 2, 30, 20, 30, 2, 50, 3, 1, 10, 90, 10, 1, 4, 10, 10, 20, 5, 5, 2, 104, 2, 4, 65]}

大单统计 000001.SZ {'time': 1708412400000, 'stime': '20240220150000.000', 'bidNumber': 12970, 'bidMostVolmue': 184542, 'bidBigVolmue': 160243, 'bidMediumVolmue': 129169, 'bidSmallVolmue': 83784, 'offNumber': 14111, 'offMostVolmue': 186663, 'offBigVolmue': 152029, 'offMediumVolmue': 125963, 'offSmallVolmue': 101332, 'bidMostAmount': 180761343.0, 'bidBigAmount': 156870635.0, 'bidMediumAmount': 126389253.0, 'bidSmallAmount': 81947349.0, 'offMostAmount': 182394933.0, 'offBigAmount': 148570065.0, 'offMediumAmount': 123102576.0, 'offSmallAmount': 98951657.0, 'ddx': 0.0, 'ddy': 4.21, 'ddz': -0.02, 'zjbyNetInflow': -7050651, 'zjbyMost': -1633589, 'zjbyBig': 8300569, 'zjbyMedium': 3286676, 'zjbySmall': -17004307, 'netOrder': 7661, 'netWithdraw': 9, 'withdrawBid': 14003, 'withdrawOff': 9304, 'unactiveBidMostVolmue': 111180, 'unactiveBidBigVolmue': 189053, 'unactiveBidMediumVolmue': 172590, 'unactiveBidSmallVolmue': 93164, 'unactiveOffMostVolmue': 81131, 'unactiveOffBigVolmue': 184351, 'unactiveOffMediumVolmue': 178101, 'unactiveOffSmallVolmue': 114155, 'unactiveBidMostAmount': 108729861.0, 'unactiveBidBigAmount': 184733639.0, 'unactiveBidMediumAmount': 168611735.0, 'unactiveBidSmallAmount': 90943995.0, 'unactiveOffMostAmount': 79344464.0, 'unactiveOffBigAmount': 180480773.0, 'unactiveOffMediumAmount': 174386422.0, 'unactiveOffSmallAmount': 111756921.0}

使用 Lv1 全推数据计算全市场涨幅

#coding:gbk

import time

class a():pass

A = a()

def init(C):

A.hsa = C.get_stock_list_in_sector('沪深A股') + C.get_stock_list_in_sector('京市A股')

print('股票池大小', len(A.hsa))

A.vol_dict = {}

for stock in A.hsa:

A.vol_dict[stock] = C.get_last_volume(stock)

C.run_time("f","3nSecond","2019-10-14 13:20:00")

def to_zw(a):

'''0.中文价格字符串'''

import numpy as np

if np.isnan(a):

return '问题数据'

if abs(a) < 1000:

print(a, str(round(int(a) / 1000.0, 2)) + "千")

return str(round(int(a) / 1000.0, 2)) + "千"

if abs(a) < 10000:

return str(int(a))[0] + "千"

if abs(a) < 100000000:

return str(int(a))[:-4] + "万" + str(int(a))[-4]

return f"{int(a / 100000000)}亿"

def f(C):

t0 = time.time()

full_tick = C.get_full_tick(A.hsa)

total_market_value = 0

total_ratio = 0

count = 0

total_amount = 0

ratio_list = []

for stock in A.hsa:

ratio = full_tick[stock]['lastPrice'] / full_tick[stock]['lastClose'] - 1

amount = full_tick[stock]['amount']

total_amount += amount

rise_price = round(full_tick[stock]['lastClose'] *1.2,2) if stock[0] == '3' or stock[:3] == '688' else round(full_tick[stock]['lastClose'] *1.1,2)

#如果要打印涨停品种

#if abs(full_tick[stock]['lastPrice'] - rise_price) <0.01:

# print(f"涨停品种 {stock} {C.get_stock_name(stock)}")

market_value = full_tick[stock]['lastPrice'] * A.vol_dict[stock]

total_ratio += ratio * market_value

total_market_value += market_value

count += 1

ratio_list.append(ratio)

#print(count)

total_ratio /= total_market_value

total_ratio *= 100

middle = int(len(ratio_list) / 2)

middle_ratio = ratio_list[middle]

rise_num = len([i for i in ratio_list if i > 0])

down_num = len([i for i in ratio_list if i < 0])

print(f'A股加权涨幅 {round(total_ratio,2)}% 涨幅中位数 {round(middle_ratio,2)}% {rise_num}个上涨 {down_num}个下跌 成交金额 {to_zw(total_amount)} 耗时{round(time.time()- t0,5)}秒')

在行情回调函数里处理动态行情

ContextInfo.subscribe_quote - 订阅行情函数说明

行情回调函数字段说明

#coding:gbk

sub_nums = []

def init(C):

global sub_nums

# def on_quote(data1, data2): # 错误写法

def on_quote(data):

for s in data:

q = data[s]

print(type(q), q)

stocks = [C.stockcode + '.' + C.market] # 获取到当前主图股票代码

for s in stocks:

num = C.subscribe_quote(s, period='1d',

dividend_type='none',

result_type='dict', # 回调函数的行情数据格式

callback=on_quote # 指定一个自定义的函数接收行情,自定义的函数只能有一个位置参数

)

sub_nums.append(num)

def stop(C):

# 反订阅

for num in sub_nums:

C.unsubscribe_quote(num)

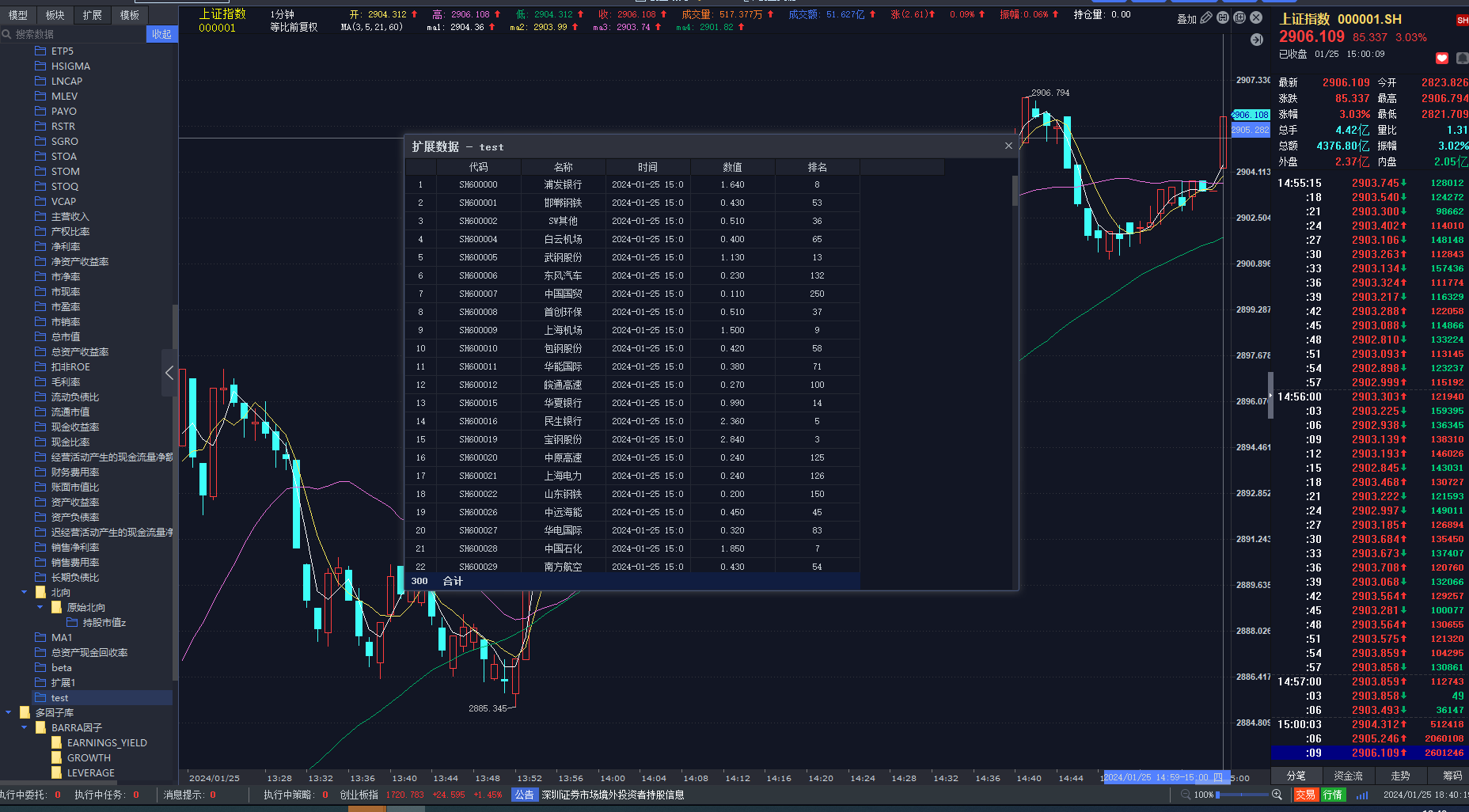

python写入扩展数据

# coding:gbk

'''

python写扩展数据,投研接口

'''

def init(C):

# 创建扩展数据

extencd_name = 'test' # 创建名为test的扩展数据

create_extend_data# (父节点, 扩展数据名称, 是否覆盖)

C.extencd_name = create_extend_data('扩展数据', extencd_name, True)

def handlebar(C):

if C.is_last_bar():

data = {'SH600177': 0.43, 'SZ000767': 0.18, 'SH600362': 0.27, 'SH600171': 0.25, 'SH600170': 0.18, 'SH600073': 0.13, 'SZ000768': 0.17, 'SH600282': 0.19, 'SH600601': 0.42, 'SH600569': 0.26, 'SZ000401': 0.21, 'SH600602': 0.17, 'SZ000806': 0.13, 'SZ000807': 0.15, 'SH600608': 0.08, 'SH600874': 0.09, 'SZ000825': 0.44, 'SZ000652': 0.19, 'SH600078': 0.11, 'SH600871': 0.1, 'SZ000573': 0.1, 'SZ000520': 0.14, 'SH600879': 0.43, 'SZ000960': 0.2, 'SH600597': 0.21, 'SZ000550': 0.1, 'SH600591': 0.14, 'SZ000059': 0.13, 'SH600215': 0.12, 'SZ000968': 0.11, 'SZ000969': 0.14, 'SZ000568': 0.22, 'SH600598': 0.22, 'SH600028': 1.85, 'SH600270': 0.27, 'SH600060': 0.22, 'SH600062': 0.15, 'SH600779': 0.14, 'SH600997': 0.2, 'SZ000707': 0.12, 'SH600068': 0.16, 'SH600770': 0.14, 'SZ000680': 0.14, 'SH600674': 0.1, 'SH600675': 0.25, 'SZ000488': 0.28, 'SZ000012': 0.11, 'SH600863': 0.17, 'SZ000429': 0.17, 'SH600027': 0.32, 'SH600866': 0.13, 'SH600001': 0.43, 'SZ000636': 0.11, 'SH600900': 2.73, 'SH600600': 0.31, 'SH600895': 0.26, 'SH600029': 0.43, 'SH600020': 0.24, 'SH600205': 0.39, 'SH600688': 0.76, 'SH600207': 0.1, 'SZ000970': 0.3, 'SZ000601': 0.19, 'SH600200': 0.35, 'SZ000975': 0.08, 'SZ000538': 0.39, 'SZ000422': 0.14, 'SZ000858': 0.88, 'SZ000651': 0.44, 'SH600780': 0.21, 'SH600007': 0.11, 'SH600016': 2.36, 'SZ000866': 0.84, 'SH600267': 0.12, 'SH600266': 0.16, 'SH600786': 0.27, 'SZ000406': 0.39, 'SH600269': 0.47, 'SZ000528': 0.19, 'SH600694': 0.51, 'SZ000786': 0.14, 'SH600004': 0.4, 'SH600663': 0.25, 'SH600662': 0.21, 'SH600548': 0.11, 'SH600383': 0.42, 'SH600357': 0.12, 'SH600705': 0.13, 'SH600812': 0.18, 'SH600707': 0.06, 'SZ000895': 0.49, 'SZ000898': 0.68, 'SZ000400': 0.17, 'SZ000607': 0.1, 'SH600894': 0.1, 'SH600418': 0.4, 'SZ000061': 0.15, 'SH600653': 0.31, 'SZ000682': 0.17, 'SZ000543': 0.07, 'SZ000541': 0.25, 'SH600377': 0.12, 'SZ000949': 0.06, 'SH600256': 0.17, 'SH600006': 0.23, 'SH600005': 1.13, 'SH600790': 0.1, 'SH600797': 0.2, 'SH600002': 0.51, 'SH600795': 0.49, 'SH600000': 1.64, 'SH600652': 0.17, 'SH600121': 0.13, 'SH600123': 0.3, 'SH600125': 0.27, 'SH600126': 0.12, 'SH600008': 0.51, 'SZ000016': 0.14, 'SH600550': 0.24, 'SH600718': 0.16, 'SH600654': 0.2, 'SZ000157': 0.2, 'SH600808': 0.42, 'SZ000666': 0.1, 'SH600805': 0.11, 'SZ000527': 0.39, 'SH600717': 0.5, 'SH600399': 0.07, 'SZ000828': 0.14, 'SZ000959': 0.17, 'SZ000729': 0.29, 'SH600098': 0.43, 'SZ000886': 0.09, 'SZ000099': 0.13, 'SZ000800': 0.29, 'SH600096': 0.29, 'SZ001872': 0.17, 'SH600091': 0.12, 'SZ000956': 0.41, 'SH600887': 0.63, 'SH600886': 0.2, 'SH600884': 0.12, 'SH600308': 0.32, 'SH600309': 0.64, 'SH600881': 0.21, 'SH600307': 0.14, 'SZ000069': 0.8, 'SZ000068': 0.1, 'SH600153': 0.19, 'SZ000792': 0.55, 'SZ000060': 0.38, 'SZ000002': 2.25, 'SZ000001': 1.25, 'SH600138': 0.1, 'SH600649': 0.44, 'SH600015': 0.99, 'SZ000533': 0.07, 'SZ000009': 0.24, 'SH600408': 0.09, 'SZ000778': 0.23, 'SH600643': 0.17, 'SH600642': 0.71, 'SH600832': 0.71, 'SZ000089': 0.36, 'SZ000088': 0.44, 'SZ000539': 0.3, 'SH600835': 0.19, 'SH600726': 0.09, 'SH600010': 0.42, 'SH600724': 0.16, 'SH600839': 0.61, 'SH600011': 0.38, 'SH600012': 0.27, 'SH600089': 0.23, 'SH600088': 0.12, 'SH600087': 0.12, 'SH600085': 0.38, 'SZ000927': 0.2, 'SZ000920': 0.11, 'SZ000962': 0.13, 'SZ000559': 0.16, 'SH600050': 2.98, 'SZ000708': 0.09, 'SZ000503': 0.36, 'SZ000839': 0.44, 'SZ000717': 0.28, 'SZ000100': 0.31, 'SZ000036': 0.18, 'SZ000878': 0.24, 'SZ000511': 0.09, 'SZ000410': 0.19, 'SH600033': 0.24, 'SH600108': 0.13, 'SZ000031': 0.21, 'SZ000507': 0.09, 'SH600104': 0.78, 'SZ002024': 0.45, 'SH600102': 0.18, 'SH600103': 0.14, 'SH600100': 0.41, 'SH600019': 2.84, 'SH600009': 1.5, 'SH600639': 0.19, 'SZ000709': 0.34, 'SH600820': 0.14, 'SZ000571': 0.1, 'SH600739': 0.13, 'SH600631': 0.25, 'SH600021': 0.24, 'SH600635': 0.22, 'SH600637': 0.15, 'SZ000733': 0.09, 'SZ000780': 0.09, 'SH600210': 0.25, 'SZ000939': 0.12, 'SZ000937': 0.26, 'SZ000875': 0.15, 'SZ000933': 0.22, 'SZ000932': 0.51, 'SZ000659': 0.15, 'SZ000930': 0.38, 'SH600320': 0.8, 'SZ000822': 0.17, 'SZ000726': 0.14, 'SZ000727': 0.1, 'SZ000725': 0.13, 'SH600380': 0.14, 'SH600030': 0.63, 'SH600031': 0.16, 'SH600036': 3.93, 'SH600037': 0.62, 'SH600035': 0.16, 'SH600058': 0.2, 'SH600110': 0.13, 'SH600508': 0.19, 'SZ000402': 0.62, 'SH600115': 0.1, 'SH600117': 0.13, 'SZ000423': 0.22, 'SH600348': 0.34, 'SZ000518': 0.14, 'SH600500': 0.26, 'SH600660': 0.37, 'SH600057': 0.09, 'SH600744': 0.12, 'SH600747': 0.11, 'SH600740': 0.09, 'SH600741': 0.17, 'SH600621': 0.11, 'SZ000698': 0.14, 'SH600851': 0.19, 'SZ000900': 0.28, 'SH600854': 0.1, 'SH600868': 0.25, 'SH600428': 0.3, 'SZ000630': 0.36, 'SH600811': 0.3, 'SZ000735': 0.1, 'SZ000737': 0.09, 'SZ000066': 0.19, 'SH600331': 0.25, 'SH600183': 0.27, 'SH600333': 0.1, 'SZ000581': 0.25, 'SZ000425': 0.11, 'SZ000983': 0.49, 'SH600236': 0.25, 'SH600026': 0.45, 'SH600339': 0.08, 'SH600231': 0.16, 'SH600188': 0.27, 'SH600022': 0.2, 'SH600166': 0.08, 'SH600350': 0.37, 'SH600519': 1.14, 'SZ000063': 1.49, 'SH600690': 0.44, 'SZ000758': 0.24, 'SH600296': 0.26, 'SH601607': 0.17, 'SHT00018': 0.8, 'SZ000039': 0.78, 'SZ000599': 0.1, 'SH600198': 0.21, 'SZ000917': 0.15, 'SZ000916': 0.22, 'SZ000912': 0.21, 'SH600190': 0.11, 'SH600196': 0.25, 'SH600583': 0.54, 'SH600581': 0.12, 'SZ000027': 0.6, 'SZ000629': 0.52, 'SH600585': 0.32, 'SZ000021': 0.26, 'SZ000625': 0.25, 'SZ000623': 0.18, 'SZ000024': 0.42, 'SH600221': 0.13, 'SH600220': 0.17}

timetag = C.get_bar_timetag(C.barpos)

stock_list = list(data.keys())

print(stock_list)

#设置需要写入的扩展数据股票列表

#reset_extend_data_stock_list(扩展数据名称, 股票列表)

reset_extend_data_stock_list(C.extencd_name, stock_list)

# 执行写入扩展数据

# set_extend_data_value(扩展数据名称,时间戳(毫秒),数据)

set_extend_data_value(C.extencd_name, timetag, data)

print('写入完成')

扩展数据展示

每1分钟统计一次市场涨跌情况

# coding:gbk

import datetime as dt

def on_timer(ContextInfo):

ls = globals().get("stock_list")

now_time = dt.datetime.now().strftime("%Y%m%d %H:%M:%S")

# 取tick数据

ticks = ContextInfo.get_full_tick(ls)

# 涨跌统计,并去除停牌股

profit_ls = [i for i in ticks if ticks[i]["lastPrice"] > ticks[i]["lastClose"] and ticks[i]["openInt"] != 1]

loss_ls = [i for i in ticks if ticks[i]["lastPrice"] < ticks[i]["lastClose"] and ticks[i]["openInt"] != 1]

print(f"{now_time}: 涨家数{len(profit_ls)}; 跌家数{len(loss_ls)}")

def init(ContextInfo):

globals()["stock_list"] = get_stock_list_in_sector("沪深京A股")

# 自2023-12-31 23:59:59后每60s运行一次on_timer

tid=ContextInfo.schedule_run(on_timer,'20231231235959',3,dt.timedelta(seconds=60),'my_timer')

# 取消任务组为"my_timer"的任务

# # ContextInfo.cancel_schedule_run('my_timer')

# 关于schedule_run函数的用法请阅读文档http://dict.thinktrader.net/innerApi/system_function.html?id=7zqjlm#contextinfo-schedule-run-%E8%AE%BE%E7%BD%AE%E5%AE%9A%E6%97%B6%E5%99%A8

交易下单示例

按品种划分

股票

#coding:gbk

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

# 单股单账号股票最新价买入 100 股(1 手)

passorder(23, 1101, 'test', '600000.SH', 5, 0, 100, '',1,'',ContextInfo)

# 单股单账号股票最新价卖出 100 股(1 手)

passorder(24, 1101, 'test', '600000.SH', 5, 0, 100, '',1,'',ContextInfo)

# 单股单账号沪市股票市价买入 100 股(1 手),沪市市价存在保护限价,Price参数为保护限价,买入为投资者能够接受的最高买价,填0会自动填为涨停价

passorder(23, 1101, 'test', '600000.SH', 42, 0, 100, '',1,'',ContextInfo)

# 单股单账号沪市股票市价卖出 100 股(1 手),沪市市价存在保护限价,Price参数为保护限价,卖出为投资者能够接受的最低卖价,填0会自动填为跌停价

passorder(24, 1101, 'test', '600000.SH', 42, 0, 100, '',1,'',ContextInfo)

# 单股单账号京市股票最新价买入 101 股(1 手零 1 股)

passorder(23, 1101, 'test', '430047.BJ', 5, 0, 101, '',1,'',ContextInfo)

# 单股单账号京市股票最新价卖出 101 股(1 手零 1 股)

passorder(24, 1101, 'test', '430047.BJ', 5, 0, 101, '',1,'',ContextInfo)

基金

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

# 申购 中证500指数ETF

passorder(60, 1101, 'test', '510030.SH', 5, 0, 1, 2, ContextInfo)

# 赎回 中证500指数ETF

passorder(61, 1101, 'test', '510030.SH', 5, 0, 1, 2, ContextInfo)

两融

#coding:gbk

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

target = '000001.SZ'

# 单股单账号股票指定价担保品买入 100 股(1 手)

passorder(33, 1101, 'test', target, 11, 7, 100, ContextInfo)

# 单股单账号股票指定价融资买入 100 股(1 手)

passorder(27, 1101, 'test', target, 11, 7, 100, ContextInfo)

期货

#coding:gbk

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

# 单股单账号期货最新价开多螺纹钢2401 10 手

target = 'rb2401.SF'

passorder(0, 1101, 'test', target, 5, -1, 10, 1, ContextInfo)

# 单股单账号期货指定价开空甲醇2401 10 手

target = 'MA401.ZF'

passorder(3, 1101, 'test', target, 11, 3000, 10, 1, ContextInfo)

#期货四键平多300股指2311,优先平今 2手

target = 'IF2311.IF'

passorder(6, 1101, 'test', target, 5, -1, 2, 1, ContextInfo)

期权

#coding:gbk

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

target = '10005330.SHO' # 50ETF购12月2450合约

# 单股单账号用最新价买入开仓期权合约target 2张

passorder(50, 1101, 'test', target, 5, -1, 2, 1, ContextInfo)

# 单股单账号用最新价卖出平仓期权合约target 2张

passorder(51, 1101, 'test', target, 5, -1, 2, 1, ContextInfo)

新股申购

#coding:gbk

def init(C):

ipoStock=get_ipo_data("STOCK")#返回新股信息

print(ipoStock)

accont = '123456789'

for stock in ipoStock:

ipo_price = ipoStock[stock]['issuePrice'] # 发行价

maxPurchaseNum = ipoStock[stock]['maxPurchaseNum'] # 可申购额度

passorder(23,1101, accont, stock,11,ipo_price, maxPurchaseNum,'新股申购',2,stock,C)

债券

#coding:gbk

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

# 单股单账号最新价可转债买入 20张

passorder(23, 1101, 'test', '128123.SZ', 5, -1, 10, 1, ContextInfo)

ETF

#coding:gbk

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

return

# 单股单账号 最新价买入上证etf 2000份

passorder(23, 1101, 'test', '510050.SH', 5, -1, 2000, ContextInfo)

组合交易

一键买卖(一篮子下单)

功能描述: 该示例演示如何用python进行一揽子股票买卖的交易操作

代码示例:

#coding:gbk

def init(C):

table=[

{'stock':'600000.SH','weight':0.11,'quantity':100,'optType':23},

{'stock':'600028.SH','weight':0.11,'quantity':200,'optType':24},

]

basket={'name':'basket1','stocks':table}

set_basket(basket)

# 按篮子数量下单, 下2份 # 即下两倍篮子

pice = 2

passorder(35, #一键买卖

2101, # 表示按股票数量下单

account,

'basket1', # 篮子名称

5, # 最新价下单

1, # 价格,最新价时 该参数无效,需要填任意数占位

pice, # 篮子份数

'',2,'strReMark',C)

# 按篮子权重下单

table=[

{'stock':'600000.SH','weight':0.4,'quantity':0,'optType':23}, # 40%

{'stock':'600028.SH','weight':0.6,'quantity':0,'optType':24}, # 60%

]

basket={'name':'basket2','stocks':table}

set_basket(basket)

# 按组合权重 总额10000元

money = 10000

passorder(35,2102,account,'basket2',5,1,money,'',2,'strReMark',C)

组合套利交易

提示

(accountID、orderType 特殊设置)

用法

释义:

参数

| 参数名称 | 描述 |

|---|---|

| accountID | 'stockAccountID, futureAccountID' |

| orderCode | 'basketName, futureName' |

| hedgeRatio | 套利比例(0 ~ 2 之间值,相当于 %0 至 200% 套利) |

| volume | 份数 \ 资金 \ 比例 |

| orderType | 参考下方orderType-下单方式(特殊设置) |

orderType - 下单方式(特殊设置)

| 编号 | 项目 |

|---|---|

| 2331 | 组合、套利、合约价值自动套利、按组合股票数量方式下单 |

| 2332 | 组合、套利、按合约价值自动套利、按组合股票权重方式下单 |

| 2333 | 组合、套利、按合约价值自动套利、按账号可用方式下单 |

示例

按功能划分

passorder 下单函数

本示例用于演示K线走完下单及立即下单的参数写法差异,旨在帮助您了解如何快速实现下单操作。

#coding:gbk

c = 0

s = '000001.SZ'

def init(ContextInfo):

# 立即下单 用最新价买入股票s 100股,且指定投资备注

passorder(23,1101,account,s,5,0,100,'1',2,'tzbz',ContextInfo)

pass

def handlebar(ContextInfo):

if not ContextInfo.is_last_bar():

#历史k线不应该发出实盘信号 跳过

return

if ContextInfo.is_last_bar():

global c

c +=1

if c ==1:

# 用14.00元限价买入股票s 100股

passorder(23,1101,account,s,11,14.00,100,1,ContextInfo) # 当前k线为最新k线 则立即下单

# 用最新价限价买入股票s 100股

passorder(23,1101,account,s,5,-1,100,0,ContextInfo) # K线走完下单

# 用最新价限价买入股票s 1000元

passorder(23, 1102, account, s, 5, 0,1000, 2, ContextInfo) # 不管是不是最新K线,立即下单

集合竞价下单

本示例演示了利用定时器函数和passorder下单函数在集合竞价期间以指定价买入平安银行100股。

#coding:gbk

import time

c = 0

s = '000001.SZ'

def init(ContextInfo):

# 设置定时器,历史时间表示会在一次间隔时间后开始调用回调函数 比如本例中 5秒后会后第一次触发myHandlebar调用 之后五秒触发一次

ContextInfo.run_time("myHandlebar","5nSecond","2019-10-14 13:20:00")

def myHandlebar(ContextInfo):

global c

now = time.strftime('%H%M%S')

if c ==0 and '092500' >= now >= '091500':

c += 1

passorder(23,1101,account,s,11,14.00,100,2,ContextInfo) # 立即下单

def handlebar(ContextInfo):

return

止盈止损示例

#coding:gbk

"""

1.账户内所有股票,当股价低于买入价10%止损卖出。

2.账户内所有股票,当股价高于前一天的收盘价10%时,开始监控一旦股价炸板(开板),以买三价卖出

"""

def init(C):

C.ratio = 1

if accountType == 'STOCK':

C.sell_code = 24

if accountType == 'CREDIT':

C.sell_code = 34

C.spare_list = C.get_stock_list_in_sector('不卖品种')

def handlebar(C):

if not C.is_last_bar():

return

holdings = get_trade_detail_data(account, accountType, 'position')

stock_list = [holding.m_strInstrumentID + '.' + holding.m_strExchangeID for holding in holdings]

if stock_list:

full_tick = C.get_full_tick(stock_list)

for holding in holdings:

stock = holding.m_strInstrumentID + '.' + holding.m_strExchangeID

rate = holding.m_dProfitRate

volume = holding.m_nCanUseVolume

if not volume >= 100:

continue

if stock in C.spare_list:

continue

if rate < -0.1:

msg = f'{stock} 盈亏比例 {rate} 小于-10% 卖出 {volume}股'

print(msg)

passorder(C.sell_code, 1101, account, stock, 14, -1, volume, '减仓模型', 2, msg, C)

continue

if stock in full_tick:

current_price = full_tick[stock]['lastPrice']

pre_price = full_tick[stock]['lastClose']

high_price = full_tick[stock]['high']

stop_price = pre_price * 1.2 if stock[:2] in ['30', '68'] else pre_price * 1.1

stop_price = round(stop_price, 2)

ask_price_3 = full_tick[stock]['bidPrice'][2]

if not ask_price_3:

print(f"{stock} {full_tick[stock]} 未取到三档盘口价 请检查客户端右下角 行情界面 是否选择了五档行情 本次跳过卖出")

continue

if high_price == stop_price and current_price < stop_price:

msg = f"{stock} 涨停后 开板 卖出 {volume}股"

print(msg)

passorder(C.sell_code, 1101, account, stock, 14, -1, volume, '减仓模型', 2, msg, C)

continue

passorder 下算法单函数

本示例由于演示如何下达算法单,具体算法参数请参考迅投投研平台客户端参数说明。

#coding:gbk

import time

def init(C):

userparam={

'OrderType':1, #表示要下算法

'PriceType':0, # 卖5价下单

'MaxOrderCount':12, # 最大委托次数

'SuperPriceType':0, # 超价类型,0表示按比例

'SuperPriceRate':0.02, # 超价2%下单

'VolumeRate':0.1, # 单笔下单比率 每次拆10%

'VolumeType': 10, # 单笔基准量类型

'SingleNumMax':1000000, # 单笔拆单最大值

'PriceRangeType':0, # 波动区间类型

'PriceRangeRate':1, # 波动区间值

'ValidTimeType':1, # 有效时间类型 1 表示按执行时间

'ValidTimeStart':int(time.time()), # 算法开始时间

'ValidTimeEnd':int(time.time()+60*60), # 算法结束时间

'PlaceOrderInterval':10, # 报撤间隔

'UndealtEntrustRule':0, # 未成委托处理数值 用卖5加挂单

}

target_vol = 2000000 # 股, 算法目标总量

algo_passorder(23, 1101, account, '600000.SH', -1, -1, target_vol, '', 2, '普通算法', userparam, C)

print('finish')

def handlebar(C):

pass

如何使用投资备注

投资备注功能是模型下单时指定的任意字符串(长度小于24),即passorder的userOrderId参数,可以用于匹配委托或成交。有且只有passorder, algo_passorder, smart_algo_passorder下单函数支持投资备注功能。

# encoding:gbk

note = 0

def get_new_note():

global note

note += 1

return str(note)

def init(ContextInfo):

ContextInfo.set_account(account)

passorder(23, 1101, account, '000001.SZ', 5 ,0, 100, '', 2, get_new_note(), ContextInfo)

orders = get_trade_detail_data(account, accountType, 'order')

remark = [o.m_strRemark for o in orders]

sysid_list = [o.m_strOrderSysID for o in orders]

print(remark)

def handlebar(C):

pass

def order_callback(C, O):

print(O.m_strRemark, O.m_strOrderSysID)

def deal_callback(C, D):

print(D.m_strRemark, D.m_strOrderSysID)

如何获取委托持仓及资金数据

本示例用于演示如何通过函数获取指定账户的委托、持仓、资金数据。

#coding:gbk

def to_dict(obj):

attr_dict = {}

for attr in dir(obj):

try:

if attr[:2] == 'm_':

attr_dict[attr] = getattr(obj, attr)

except:

pass

return attr_dict

def init(C):

pass

#orders, deals, positions, accounts = query_info(C)

def handlebar(C):

if not C.is_last_bar():

return

orders, deals, positions, accounts = query_info(C)

def query_info(C):

orders = get_trade_detail_data('8000000213', 'stock', 'order')

for o in orders:

print(f'股票代码: {o.m_strInstrumentID}, 市场类型: {o.m_strExchangeID}, 证券名称: {o.m_strInstrumentName}, 买卖方向: {o.m_nOffsetFlag}',

f'委托数量: {o.m_nVolumeTotalOriginal}, 成交均价: {o.m_dTradedPrice}, 成交数量: {o.m_nVolumeTraded}, 成交金额:{o.m_dTradeAmount}')

deals = get_trade_detail_data('8000000213', 'stock', 'deal')

for dt in deals:

print(f'股票代码: {dt.m_strInstrumentID}, 市场类型: {dt.m_strExchangeID}, 证券名称: {dt.m_strInstrumentName}, 买卖方向: {dt.m_nOffsetFlag}',

f'成交价格: {dt.m_dPrice}, 成交数量: {dt.m_nVolume}, 成交金额: {dt.m_dTradeAmount}')

positions = get_trade_detail_data('8000000213', 'stock', 'position')

for dt in positions:

print(f'股票代码: {dt.m_strInstrumentID}, 市场类型: {dt.m_strExchangeID}, 证券名称: {dt.m_strInstrumentName}, 持仓量: {dt.m_nVolume}, 可用数量: {dt.m_nCanUseVolume}',

f'成本价: {dt.m_dOpenPrice:.2f}, 市值: {dt.m_dInstrumentValue:.2f}, 持仓成本: {dt.m_dPositionCost:.2f}, 盈亏: {dt.m_dPositionProfit:.2f}')

accounts = get_trade_detail_data('8000000213', 'stock', 'account')

for dt in accounts:

print(f'总资产: {dt.m_dBalance:.2f}, 净资产: {dt.m_dAssureAsset:.2f}, 总市值: {dt.m_dInstrumentValue:.2f}',

f'总负债: {dt.m_dTotalDebit:.2f}, 可用金额: {dt.m_dAvailable:.2f}, 盈亏: {dt.m_dPositionProfit:.2f}')

return orders, deals, positions, accounts

使用快速交易参数委托

本例展示如何使用快速交易参数(quickTrade)立刻进行委托。

#coding:gbk

def after_init(C):

#account变量是模型交易界面 添加策略时选择的资金账号 不需要手动填写

#快速交易参数(quickTrade )填2 passorder函数执行后立刻下单 不会等待k线走完再委托。 可以在after_init函数 run_time函数注册的回调函数里进行委托

msg = f"投资备注字符串 用来区分不同委托"

passorder(23, 1101, account, '600000.SH', 5, -1, 200, '测试下单', 2, msg, C)

调整至目标持仓

本示例由于演示如何调仓。

#encoding:gbk

'''

调仓到指定篮子

'''

import pandas as pd

import numpy as np

import time

from datetime import timedelta,datetime

#自定义类 用来保存状态

class a():pass

A=a()

A.waiting_dict = {}

A.all_order_ref_dict = {}

#撤单间隔 单位秒 超过间隔未成交的委托撤回重报

A.withdraw_secs = 30

#定义策略开始结束时间 在两者间时进行下单判断 其他时间跳过

A.start_time = '093000'

A.end_time = '150000'

def init(C):

'''读取目标仓位 字典格式 品种代码:持仓股数, 可以读本地文件/数据库,当前在代码里写死'''

A.final_dict = {"600000.SH" :10000, '000001.SZ' : 20000}

'''设置交易账号 acount accountType是界面上选的账号 账号类型'''

A.acct = account

A.acct_type = accountType

#定时器 定时触发指定函数

C.run_time("f","1nSecond","2019-10-14 13:20:00","SH")

def f(C):

'''定义定时触发的函数 入参是ContextInfo对象'''

#记录本次调用时间戳

t0 = time.time()

final_dict=A.final_dict

#本次运行时间字符串

now = datetime.now()

now_timestr = now.strftime("%H%M%S")

#跳过非交易时间

if now_timestr < A.start_time or now_timestr > A.end_time:

return

#获取账号信息

acct = get_trade_detail_data(A.acct, A.acct_type, 'account')

if len(acct) == 0:

print(A.acct, '账号未登录 停止委托')

return

acct = acct[0]

#获取可用资金

available_cash = acct.m_dAvailable

print(now, '可用资金', available_cash)

#获取持仓信息

position_list = get_trade_detail_data(A.acct, A.acct_type, 'position')

#持仓数据 组合为字典

position_dict = {i.m_strInstrumentID + '.' + i.m_strExchangeID : int(i.m_nVolume) for i in position_list}

position_dict_available = {i.m_strInstrumentID + '.' + i.m_strExchangeID : int(i.m_nCanUseVolume) for i in position_list}

#未持有的品种填充持股数0

not_in_position_stock_dict = {i : 0 for i in final_dict if i not in position_dict}

position_dict.update(not_in_position_stock_dict)

#print(position_dict)

stock_list = list(position_dict.keys())

# print(stock_list)

#获取全推行情

full_tick = C.get_full_tick(stock_list)

#print('fulltick', full_tick)

#更新持仓状态记录

refresh_waiting_dict(C)

#撤超时委托

order_list = get_trade_detail_data(A.acct, 'stock', 'order')

if '091500'<= now_timestr <= '093000':#指定的范围內不撤单

pass

else:

for order in order_list:

#非本策略 本次运行记录的委托 不撤

if order.m_strRemark not in A.all_order_ref_dict:

continue

#委托后 时间不到撤单等待时间的 不撤

if time.time() - A.all_order_ref_dict[order.m_strRemark] < A.withdraw_secs:

continue

#对所有可撤状态的委托 撤单

if order.m_nOrderStatus in [48,49,50,51,52,55,86,255]:

print(f"超时撤单 停止等待 {order.m_strRemark}")

cancel(order.m_strOrderSysID,A.acct,'stock',C)

#下单判断

for stock in position_dict:

#有未查到的委托的品种 跳过下单 防止超单

if stock in A.waiting_dict:

print(f"{stock} 未查到或存在未撤回委托 {A.waiting_dict[stock]} 暂停后续报单")

continue

if stock in position_dict.keys():

#print(position_dict[stock],target_vol,'1111')

#到达目标数量的品种 停止委托

target_vol = final_dict[stock] if stock in final_dict else 0

if int(abs(position_dict[stock] - target_vol)) == 0:

print(stock, C.get_stock_name(stock), '与目标一致')

continue

#与目标数量差值小于100股的品种 停止委托

if abs(position_dict[stock] - target_vol) < 100:

print(f"{stock} {C.get_stock_name(stock)} 目标持仓{target_vol} 当前持仓{position_dict[stock]} 差额小于100 停止委托")

continue

#持仓大于目标持仓 卖出

if position_dict[stock]>target_vol:

vol = int((position_dict[stock] - target_vol)/100)*100

if stock not in position_dict_available:

continue

vol = min(vol, position_dict_available[stock])

#获取买一价

print(stock,'应该卖出')

buy_one_price = full_tick[stock]['bidPrice'][0]

#买一价无效时 跳过委托

if not buy_one_price > 0:

print(f"{stock} {C.get_stock_name(stock)} 取到的价格{buy_one_price}无效,跳过此次推送")

continue

print(f"{stock} {C.get_stock_name(stock)} 目标股数{target_vol} 当前股数{position_dict[stock]}")

msg = f"{now.strftime('%Y%m%d%H%M%S')}_{stock}_sell_{vol}股"

print(msg)

#对手价卖出

passorder(24,1101,A.acct,stock,14,-1,vol,'调仓策略',2,msg,C)

A.waiting_dict[stock] = msg

A.all_order_ref_dict[msg] = time.time()

#持仓小于目标持仓 买入

if position_dict[stock]<target_vol:

vol = int((target_vol-position_dict[stock])/100)*100

#获取卖一价

sell_one_price = full_tick[stock]['askPrice'][0]

#卖一价无效时 跳过委托

if not sell_one_price > 0:

print(f"{stock} {C.get_stock_name(stock)} 取到的价格{sell_one_price}无效,跳过此次推送")

continue

target_value = sell_one_price * vol

if target_value > available_cash:

print(f"{stock} 目标市值{target_value} 大于 可用资金{available_cash} 跳过委托")

continue

print(f"{stock} {C.get_stock_name(stock)} 目标股数{target_vol} 当前股数{position_dict[stock]}")

msg = f"{now.strftime('%Y%m%d%H%M%S')}_{stock}_buy_{vol}股"

print(msg)

#对手价买入

passorder(23,1101,A.acct,stock,14,-1,vol,'调仓策略',2,msg,C)

A.waiting_dict[stock] = msg

A.all_order_ref_dict[msg] = time.time()

available_cash -= target_value

#打印函数运行耗时 定时器间隔应大于该值

print(f"下单判断函数运行完成 耗时{time.time() - t0}秒")

def refresh_waiting_dict(C):

"""更新委托状态 入参为ContextInfo对象"""

#获取委托信息

order_list = get_trade_detail_data(A.acct,A.acct_type,'order')

#取出委托对象的 投资备注 : 委托状态

ref_dict = {i.m_strRemark : int(i.m_nOrderStatus) for i in order_list}

del_list = []

for stock in A.waiting_dict:

if A.waiting_dict[stock] in ref_dict and ref_dict[A.waiting_dict[stock]] in [56, 53, 54]:

#查到对应投资备注 且状态为成交 / 已撤 / 部撤, 从等待字典中删除

print(f'查到投资备注 {A.waiting_dict[stock]},的委托 状态{ref_dict[A.waiting_dict[stock]]} (56已成 53部撤 54已撤)从等待等待字典中删除')

del_list.append(stock)

if A.waiting_dict[stock] in ref_dict and ref_dict[A.waiting_dict[stock]] == 57:

#委托状态是废单的 也停止等待 从等待字典中删除

print(f"投资备注为{A.waiting_dict[stock]}的委托状态为废单 停止等待")

del_list.append(stock)

for stock in del_list:

del A.waiting_dict[stock]

获取融资融券账户可融资买入标的

#coding:gbk

def init(C):

r = get_assure_contract('123456789')

if len(r) == 0:

print('未取到担保明细')

else:

finable = [o.m_strInstrumentID+'.'+o.m_strExchangeID for o in r if o.m_eFinStatus==48]

print('可融资买入标的:', finable)

获取两融账号信息示例

#coding:gbk

def init(C):

account_str = '11800028'

credit_account = query_credit_account(account_str, 1234, C)

def credit_account_callback(C,seq,result):

print('可买担保品资金', result.m_dAssureEnbuyBalance)

直接还款示例

该示例演示使用python进行融资融券账户的还款操作。

#coding:gbk

def init(ContextInfo):

# 用passorder函数进行融资融券账号的直接还款操作

money = 10000 #还款金额

#account='123456'

s = '000001.SZ' # 代码填任意股票,占位用

passorder(32, 1101, account, s, 5, 0, money, 2, ContextInfo)

# passorder(75, 1101, account, s, 5, 0, money, 2, ContextInfo) 专项直接还款

交易数据查询示例

#coding:gbk

def to_dict(obj):

attr_dict = {}

for attr in dir(obj):

try:

if attr[:2] == 'm_':

attr_dict[attr] = getattr(obj, attr)

except:

pass

return attr_dict

def init(C):

pass

#orders, deals, positions, accounts = query_info(C)

def handlebar(C):

if not C.is_last_bar():

return

orders, deals, positions, accounts = query_info(C)

def query_info(C):

orders = get_trade_detail_data('8000000213', 'stock', 'order')

for o in orders:

print(f'股票代码: {o.m_strInstrumentID}, 市场类型: {o.m_strExchangeID}, 证券名称: {o.m_strInstrumentName}, 买卖方向: {o.m_nOffsetFlag}',

f'委托数量: {o.m_nVolumeTotalOriginal}, 成交均价: {o.m_dTradedPrice}, 成交数量: {o.m_nVolumeTraded}, 成交金额:{o.m_dTradeAmount}')

deals = get_trade_detail_data('8000000213', 'stock', 'deal')

for dt in deals:

print(f'股票代码: {dt.m_strInstrumentID}, 市场类型: {dt.m_strExchangeID}, 证券名称: {dt.m_strInstrumentName}, 买卖方向: {dt.m_nOffsetFlag}',

f'成交价格: {dt.m_dPrice}, 成交数量: {dt.m_nVolume}, 成交金额: {dt.m_dTradeAmount}')

positions = get_trade_detail_data('8000000213', 'stock', 'position')

for dt in positions:

print(f'股票代码: {dt.m_strInstrumentID}, 市场类型: {dt.m_strExchangeID}, 证券名称: {dt.m_strInstrumentName}, 持仓量: {dt.m_nVolume}, 可用数量: {dt.m_nCanUseVolume}',

f'成本价: {dt.m_dOpenPrice:.2f}, 市值: {dt.m_dInstrumentValue:.2f}, 持仓成本: {dt.m_dPositionCost:.2f}, 盈亏: {dt.m_dPositionProfit:.2f}')

accounts = get_trade_detail_data('8000000213', 'stock', 'account')

for dt in accounts:

print(f'总资产: {dt.m_dBalance:.2f}, 净资产: {dt.m_dAssureAsset:.2f}, 总市值: {dt.m_dInstrumentValue:.2f}',

f'总负债: {dt.m_dTotalDebit:.2f}, 可用金额: {dt.m_dAvailable:.2f}, 盈亏: {dt.m_dPositionProfit:.2f}')

return orders, deals, positions, accounts